The global pandemic has resulted in a significant fall in the number of job vacancies in UX roles. Has interest in UX also dropped or is the job market situation simply a reflection of the global lockdown? The financial crisis of 2007 is our closest global comparator of a financial recession when digital existed. So, is there anything we can learn?

The digital landscape in the aftermath of the 2007 crisis

The world was a very different digital place when the 2007 financial crisis kicked in. In the United States a poll by ChangeWave Research in June 2009 reported that 37% of consumers owned a smartphone, and more than 14% planned to buy one in the next three months. The mobile phone market was dominated by Nokia, now just returning under licence having been almost wiped out. Google hadn’t even launched Android, that came in September 2008. Contrast that to February 2019 when smartphone ownership in the US was at 81% of the population.

The impact of the recession on consumer spending was felt in eCommerce in 2008. eCommerce sales in the US had experienced years of double digit growth but in 2008 growth was only 4.6% and 2009 was forecast to be worse, contracting 0.4%. Interestingly, Businesswire suggested that online retailers “with superior customer service, rich product information and greater shopping conveniences” would have the best chance of winning new customers. How many of them headed that warning?

This was also a time when information gathering habits were changing. Pew Research published a report in July 2009 about the impact of the recession on the internet. One of the major changes recorded was how people accessed information about the ongoing recession.

I have occasionally monitored the stock market. As it began to tumble dramatically I took a much more close interest by monitoring every day. Prior to that, the particular moment for me that caused me to begin to worry about the turn the economy was taking was learning about the shenanigans the financial institutions were up to and how it was destroying some families’ lives…. Now I watch what is happening with the mortgage companies, loan lenders, automakers, etc. worrying about the devaluation my house is undergoing because of this situation. I check throughout each week for what major company/corporation is going bankrupt, being consumed by larger sharks, and dread what might happen to my own financial institution. I pay closer attention to how rapidly the dollar is devaluing. I worry about where all this will end, knowing that even when it does it will take a very long time for the American economy to recover.

At the time the Internet was the 3rd most popular source of information behind TV & Radio (1st), newspapers & magazine (2nd). Today the question is more about which type of online media people use, with social media one of the most popular internet channels for news. So it is a very different landscape that we find ourselves in now.

UX vacancies and salaries

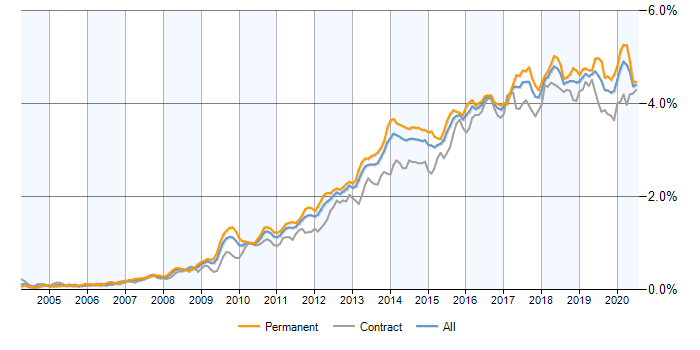

In the 3-months to July 30th 2020, we have seen a significant reduction in the number of jobs citing “User Experience” in the UK. According to data from ITJobsWatch there are 952 permanent jobs available compared with 3,480 in the same period of 2019. Worse news is that the proportion of UX jobs versus all permanent jobs is also lower, 4.43% vs 4.99% in the same period so UX is being hit harder.

At the same time contract roles are also down with 565 vs 1,838 for 3-months to July 30th in 2020 and 2019 respectively. Although the proportion of contract roles against the total is higher at 4.25% vs 4.11%.

If we look at the data over time, we can see what happened after the financial crisis of 2007 and what is happening now.

Seemingly the financial crisis of 2007 had very little impact on the UX jobs market. There are a number of reasons for this. Not least that digital was still in it’s relative infancy and UX was a relatively new field.

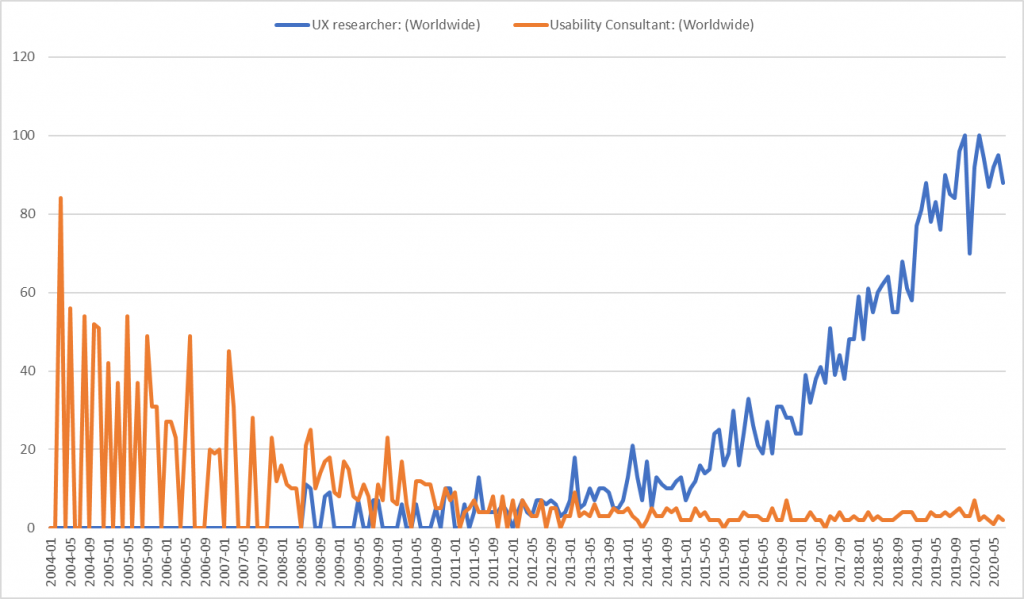

As the data from Google trends shows, the impact of the 2007 financial crisis was being felt at the same time the UX industry was shifting from “usability” to “UX”:

The cross-over point was 2012 but even in 2009 we are starting to see the term UX Research catch up with Usability Consultant.

It is useful then to look at the industry surveys from the User Experience Professionals Association (UXPA), previously the usability professionals association. The UXPA published an annual salary survey almost every year from 2005 to 2013.

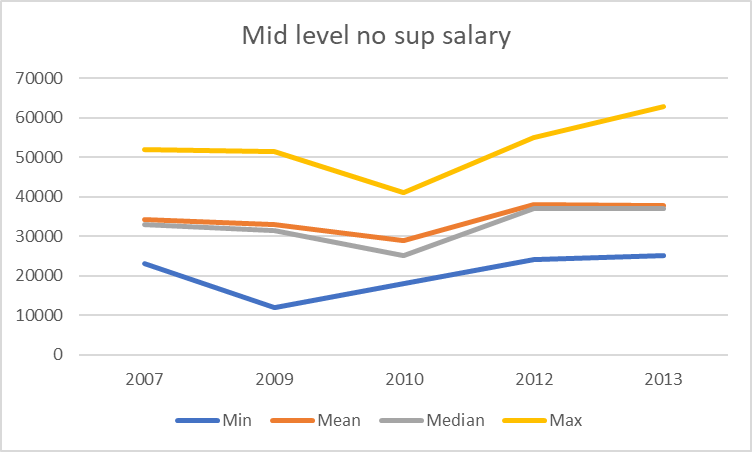

Using this data we can remove the job title issue and look at salary trends over time. This chart shows the salary progress between 2007 and 2013 for a mid-level, non-supervisory employee:

We can see that following the financial crisis, salaries did fall, particularly at the lower end. But by 2010 they had reached peak bottom and started to recover. Four years after the financial crisis salary levels had recovered and at the top level were rising.

Comparing interest in UX

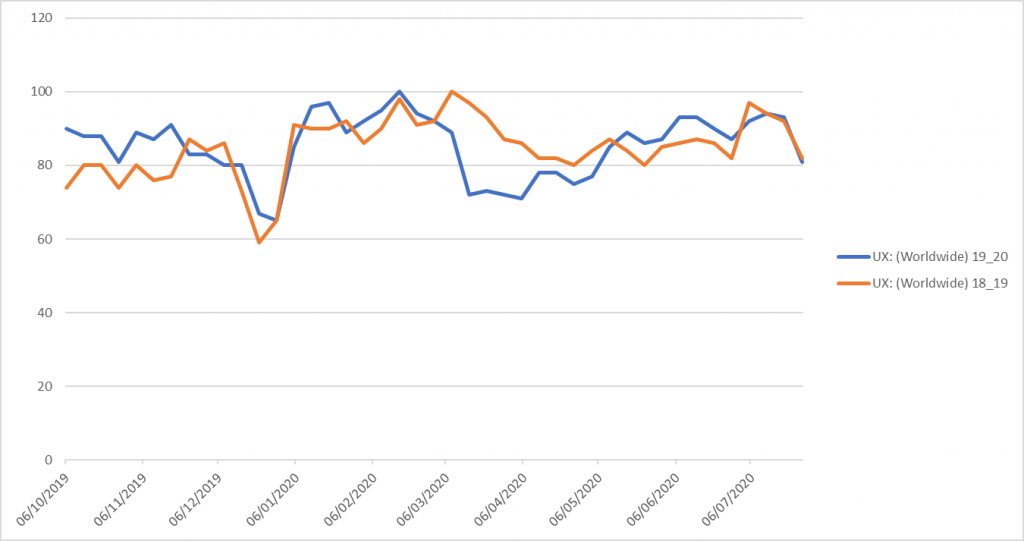

To gauge whether interest in UX is dropping we can look to Google trends data. Comparing the period 1/10/2018-30/07/2019 with 01/10/2019-30/07/2020 we can plot the interest in UX worldwide:

There is a significant drop in March 2020, as the pandemic hit, when compared with 2019 but by May 2020 interest in UX is higher than in the previous year.

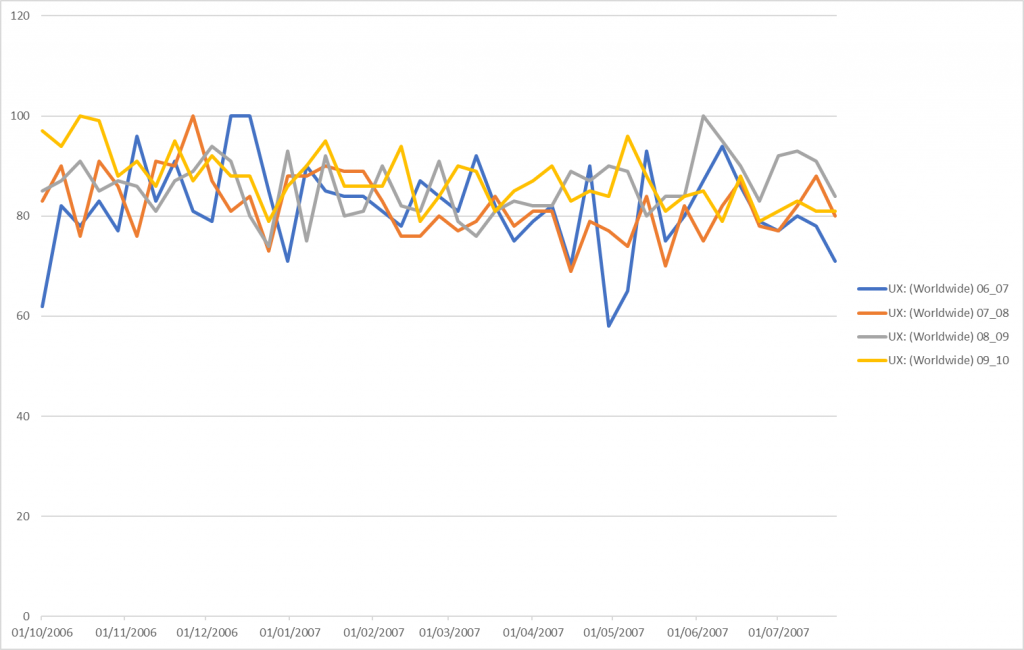

The financial crisis of 2007 had repercussions that lasted a number of years, as the global pandemic may also have, so we have to compare a wider date range to see any effects. For the period 1st October to 30th July for each of the periods 2006/2007, 07/08, 08/09 and 09/10 we see the following:

The chart shows a major drop in interest in May 2007 but the recovery was swift and in the following 3 periods only 2008/09 performed significantly better.

It is worth noting that that volume of searches for each of the periods hasn’t changed much over time as the table below shows:

| Period | 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2018/19 | 2019/20 |

| Total searches WW | 3,587 | 3,531 | 3,696 | 3,750 | 3,648 | 3,667 |

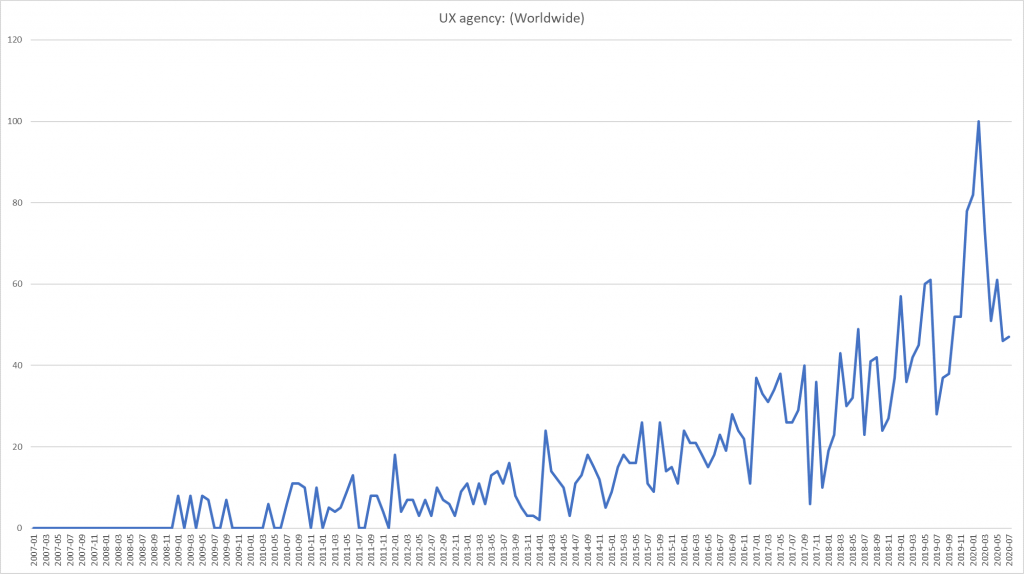

UX Agency searches

Searches for “UX Agency” have taken a tumble. It wasn’t until late 2008 that anyone searched for a UX Agency but since then we can see continued growth. From 2018 onwards the growth curve is much steeper peaking in February 2020 just before the pandemic exploded.

Since then we have returned to 2019 levels, same as with the overall interest in user experience. Whilst there has been a steep decline, the backdrop was against a peak.

UX in 2021 and beyond

We are only at the beginning of the pandemic, however long it feels like it has been going on. The economic impact will be felt in 2021 and most likely long beyond as this will be a supply side and a demand side recession, which is different to 2007.

Digital is far more mature. The growth in smartphones that took place after the 2007 economic crisis won’t happen again. Nor will we have the benefit of massive behavioural changes with exponential rises in internet usage.

However, the data indicates that already UX is in recovery. The enormous change in online shopping behaviour caused by the lockdown has caused many retailers to consider how they are addressing the digital opportunity. They cannot afford to lose out if the majority continue to shop online.

From a vacancy perspective I think it likely therefore that the job market will pick up as the lockdown ends. Salaries and day rates may be suppressed for a few years but that may not be a bad thing. Speaking from the agency perspective sell out rates to clients have been static or dropping for a number of years against a backdrop of rising employment costs. A bit of re-calibration will be welcome.

I am cautiously optimistic therefore. The main challenge for many agencies will be surviving until the recovery begins.

UX24/7 is a global UX Research Agency and we are working hard to keep going during the global pandemic. We can help you to understand your customers better and develop better products. If you have a project in mind, ring us on +44(0)800 024624 or email us at hello@ux247.com.