Whether you’re planning to launch a product in a new market or you’ve already done so, it’s vital to understand how users in different cultures will engage with your product and what their needs are. Failure to do this and you’re destined to end up with an underperforming product and inconsistency in performance across markets.

Here we will detail, along with an example, how you can avoid cultural misunderstandings when it comes to user interaction with your products.

Products and Cultural Misunderstandings

We’re going to use the example of one of our clients, Boden. In this case they hadn’t planned to enter the Chinese market but customers in the country found out about them and started making purchases on the website.

This shows that even if you don’t actively plan to enter a new market, you can end up with users there inadvertently. It’s always best to do your UX research before you enter a new market but in this case that’s obviously not possible, so Boden needed to act fast to get the insight that they needed to seize this opportunity for expansion.

Boden and their new organic opportunity

Boden started business in 1991 as a small UK mail order business with just eight menswear products. A lot has changed since then. Boden now offer premium fashion for all and they’ve excelled in the digital space, expanding operations across America, Germany and other international markets. Boden is now one of the most recognised brands for premium fashion online in the markets that it operates in.

Boden’s activity in the Chinese market came about completely organically when Chinese customers started placing orders via the UK website. The UK website was written in English, not translatable and they had nothing in place to support customers in China. All they had was transaction data.

In order to better serve the local Chinese market, Boden needed to act fast to find out how consumers were interacting with the UK website and to understand what they needed to do to create an effective dedicated website for the Chinese market. That’s when they called in our team at UX24/7 to design and deliver a UX research project in Beijing.

Understanding product users and their culture in foreign markets

When you’re entering a new market, whether you’ve planned to or it has happened inadvertently, it’s vital that you understand the customer base, the market, the different behaviours, and what you need to do to conduct e-commerce successfully.

That’s why UX research plays such a pivotal role in determining the level of success that you will have in each market.

You need to be able to answer these questions:

- What is specific or unique about customers in the market?

- How do they behave and interact with businesses like yours?

- Do they have any unique preferences?

- What design styles would be most appropriate?

This will help you shape your product development and go-to-market strategies. Research is the unequivocal first step that should precede everything else that you do.

Fact-checking your assumptions

Every business when launching a product in a new market will have their assumptions about user behaviour and what they need to do to match their needs, but not all of them will be correct.

You might think that your hottest new feature will be a big hit in a new foreign market just like it is in your local market, but it may be of no interest to users in a different cultural environment.

You need to meticulously research every aspect of your product and the buyer journey. Only then will you understand how you need to adapt your product for the foreign market, and how you should communicate your offering to users in the new market.

Research à Product development à Go-to-market strategy

In that order.

How to carry out product research

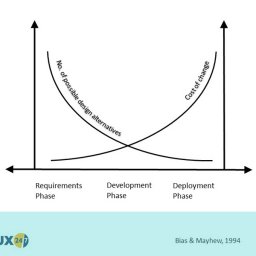

UX research allows you to gather data so that you can make business decisions based on facts not assumptions.

Here’s a framework that we use at UX24/7 to help guide our research projects.

Clearly defined customers

- Who are we targeting for our product?

- What are their attributes and how do they differ to our home market?

- What are their behaviours?

Reliable competitor insight

- What have your competitors done for this market?

- What can we learn from them?

- Are there local competitors we are not aware of?

Market innovation opportunities

- Do we understand local market behaviour and what that means for our product?

- What are the innovation opportunities for our product to help it compete here?

- Can opportunities in this market help our product compete elsewhere?

We cover all these topics on our blog. In this article we’re focusing on clearly defining your customers so that you can make sure your product, and how you deliver it, meets the needs of users in a foreign market. This in turn will make sure you avoid cultural misunderstandings and set yourself up for attracting happy users and overall product success.

Back to the Boden example we shared earlier, let’s look at what we did in that case. We specifically wanted to understand:

- How Chinese consumers interact with international brands

- The localisation challenges for e-commerce and what needs to be done to facilitate the sale and drive conversion

- The channels Chinese consumers use to learn about brands, buy products and share information with friends and colleagues

- The delivery challenges Chinese consumers experience when buying online from international websites

It’s always important to have specific goals for your research and clarity of focus so that you can organise the most appropriate methodology.

For Boden we wanted to include the following research activities:

- User research conducted in Beijing

- Online shopping behaviour and usability analysis

- 12 x one-to-one sessions on mobile and desktop

We put a local team in place to work on this over a two-day period. The client joined us too.

The project organisation involved:

- Creating a recruitment screener to build up a list of possible participants

- Assembling our own UX research capability in the area

At UX24/7 we have accredited practitioners in China so we selected the task force and made sure that it was packed with local knowledge – essential to ensure the smooth running of the project.

The research itself involved the moderation of twelve individual sessions over two days on both mobile and desktop devices, followed by analysis and reporting. We provided the client with a simultaneous translator to allow them to follow the conversation and listen to the feedback in the research room to gain insight first-hand, which is incredibly valuable. This is much more tangible and impactful than them simply reading a report.

How we research is bespoke to each client project. How you research will depend on your type of product, the market you’re entering and the resource you have available. Common methods include using:

- UX recruiting tools to find participants

- UX usability testing tools

- Surveys

- Interviews

- UX tracking and analytics tools

Then you can analyse your findings, document them and share them with key stakeholders. Find out more about the helpful tools you can use here: Best tools for user research.

Understanding new users in foreign markets

Ultimately this is your goal. Achieving it will make sure there are no cultural misunderstandings when you launch your product in the new market.

This all comes down to effective UX research and then your ability to act on your findings.

Without comprehensive research you run the risk of an unsuccessful product launch and inconsistent performance. Importantly too, good research isn’t just about making sure your product fits, it can help you uncover whole new opportunities that otherwise you may have missed. Investing in quality UX research can revolutionise businesses.

Moving forward to product localisation

Product localisation is the process of adapting your product for a foreign market.

The task is to make your product accessible and in-demand by adapting it to reflect the language, cultural, and UX needs of customers in the new market.

This could involve a range of extensive amendments to the product and how you promote and deliver it, or you may just need to make some simple tweaks.

Generally, this will depend on how vast the cultural differences are between your primary market and the new market. For an e-commerce business like Boden the majority of changes will likely be on the website. These could include:

- Text translation

- Adapting graphics to target markets

- Modifying content to suit tastes and consumption habits of other markets

- Adapting design and layout to fit the translated text

- Using local formats for dates, addresses, and phone numbers

- Complying with local regulations and legal requirements

You may choose to build a whole new website for the new market and acquire a local URL.

Then you need to look at the rest of the business. You need all-new marketing campaigns and materials. How you deliver customer orders may need to be different.

Once you’ve made the relevant product changes you can then start to shape your go-to market strategy.

The ultimate goal is to help your new customers interact with your product easily whilst giving them the experience that they want.

We can help with your UX research

At UX24/7 we can provide expert UX research services internationally for you, like we did for Boden.

If you would like to know more about this interesting and potentially extremely useful technique, ring us on +44(0)800 024624 or email us at hello@ux247.com.