We receive sales inquiries asking if we will provide participant recruitment only services, which we don’t – we are full service only for the record. I often interrogate why they have come to us rather than do it themselves and offer help and advice where I can. If they have the capability to run the research properly my view is that they should be able to to recruit participants.

Sometimes the reason is quite simply they don’t have a research operations resource and the UX researchers don’t have time to organise recruitment. That get’s a bit of a “hmmm” reaction from me, but it can happen so let’s assume it’s the real reason. To me it is part of the research so there is no excuse for not having time – just poor planning.

By far and away the most frequent reply is that they have trouble getting the right participants when working directly with field recruitment agencies. When I hear that I know immediately that they have a problem with their process. I share our process with them and I thought I’d put it in a post so that I can point people toward it when they get stuck.

Our recruitment process

First thing to say is this works for us. It doesn’t mean it is the only way to do it and other individuals and agencies may well have found better ways that work for them. You should do the same; take the best of what you find and make it work for you.

The key steps in the process are as follows, with each expanded on below:

- Agree the details with the Client/stakeholder

- Create the profile/s

- Draft the screener

- Brief the recruitment agency

- Manage the recruitment process

- Process the candidates

For reasons of keeping this post light I have left off all the GDPR stuff that goes with the process. If you don’t know that you probably shouldn’t be doing research in the first place!

Agree the details with the Client/stakeholder

In most cases the client team will have a good idea about their audience and can provide a bulleted list of profile points such as:

- gender split

- age range/brackets

- employment status

- socio-economic grouping

- etc

Even when they can, it is important to discuss the objectives of the research with them and to envisage how the sessions might run. This will often uncover additional details that should be included in the profile, like behaviors, or tech used, app usage, media habits etc. In my experience if this stage is skipped, and you proceed with just the initial profiles, you never really recover the project. You end up compromising the research because the participant profile doesn’t quite match what you need to deliver the insight.

Create the profile/s

Creating the initial profile/s is simply the stage when you playback to the client what you discussed and agreed with them. Here is an example of the level of detail we might get into (fictional data):

- 12 participants

- Equal split male/female

- Age range 18 to 65

- 4 in each of the brackets 18 to 24, 25 to 45, 46 to 65

- Native language speaker (for appropriate market)

- Mix of single and those with a partner and with children

- Working status: all can be full time employed, max of 6 can be part time, max of 2 can be students

- Annual income ranges: $18 to $40k, $41k to $70k, above $70k

- Home ownership: mix of renter and homeowner

- Device use: 6 must shop with smartphone as primary device, 6 must shop with laptop as primary device

- Must be in the market for X product or services within the next 3 months

There could be other criteria and this is just a selection to illustrate the detail we play back to the client. We ask for feedback or sign-off and will iterate the profile until everyone is agreed. We may suggest changes ourselves based on our experience of feasibility, a profile or in a market.

Draft the screener

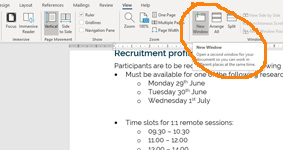

With the profile signed off we draft the screener. The way we work is to include the profile at the top of the screener and, because we work in Microsoft office and with MS Word, we use the “New Window” function and open the same document twice so we can have it side by side. We then work through methodically ensuring that each profile point is defined by the screener questions. Here is a screen grab showing where the new window function is – in case you don’t know.

Where a lot of people go wrong is not writing good screener questions. They need to avoid leading or revealing which is the answer we are looking for. Here is a simple example based on our need to recruit someone in the age group 18 to 24:

The wrong way: “Are you in the age range 18 to 24? If not we don’t need you for this research.”

The correct way: “Which of the following age brackets do you fall into?”

- under 18 [thank and close]

- 18 to 24 [record and proceed]

- 25 to 35 [thank and close]

- 36 to 45 [thank and close]

- 46 and over [thank and close]

The [square brackets] are our instructions to the recruiter. In truth I don’t think I have ever seen anyone write a question as badly as the wrong version above but hopefully it illustrates the dual problems of leading and telling them what we want.

We always go through an approval process of the screener with our client and only proceed when it is signed off. That is not because we want to avoid our responsibility to get the recruitment right but to involve them in the decision over who will be seen in the research.

Brief the recruitment agency

Not all field work recruiters have a structured and consistent method for sharing data back with us. Some don’t even use passwords (sorry I said I wouldn’t cover GDPR) and some will just send a list of names and contact details back. We want to see the score for every screener question so part of our brief to the recruiter is about how they will share the data back and in what format.

We will also provide a narrative description of the project for their benefit only – clearly marked so that it is not shared with the candidates. By helping the recruiter to understand what we are trying to achieve through the research we avoid them asking for flexibility that we cannot give them, and to think on their feet if we have missed something – it does happen.

Manage the recruitment process

When recruitment is underway we keep in touch with the recruiter to check on how they are doing and pick up any early warnings. Our level of contact is directly related to the complexity of the profile and for simple projects we may have hardly any contact until we receive the profiles back. For complex recruits we might be speaking every day.

This is the shortest section of this process but the longest in time. Recruitment is likely to be in the field for 2 to 4 weeks and we plan to check in and make contact as part of our project timeline.

Process the candidates

Finally, we receive the candidate profiles back. At this stage I still call them candidates because we need to approve them for the research. We check the profile of each and every one to make sure they have been screened correctly. If there are any areas of concern we will flag them to the recruiter and if appropriate, ask for replacements.

We work with some really great recruitment partners and receive a very good service from them. Even so, most are reluctant to find replacements once they send the final list as they consider their job done. It is very important to establish with them up front that any deviation from the screener needs to be authorised and that replacements will be expected otherwise. As with everything, the success of the process is good relationships and communication with your partners so it is important to treat them as part of the extended team.

So there is it. That is how we manage to recruit good participant 99.9% of the time for our design research projects.

If you would like us to run UX research for you the right way, get in touch on +44(0)800 024624 or email us at hello@ux247.com.